GENERAL PRINCIPLES - EXPORTING TO THE EU (EBA)

As a Least Developed Country (LDC), Laos benefits from the most favourable regime available under the EU’s Generalised Scheme of Preferences (GSP), namely the Everything But Arms (EBA) scheme.

The EU’s GSP regulation allows vulnerable developing countries to pay fewer or no duties on exports to the EU, giving them vital access to the EU market and contributing to their growth. The EBA scheme is one arm of the GSP, which grants duty-free and quota-free access to the EU for all products (except arms and ammunition) for the world’s Least Developed Countries, as defined by the United Nations.

The 27 Member States of the EU form a single territory for customs purposes. This implies that the EU is a Customs Union, meaning that its Member States have no customs duty barriers between themselves and they all have a common customs tariff for imported goods. Moreover, once customs duties have been duly paid and compliance with import conditions has been inspected, imported goods are free to circulate within the rest of the EU without any further customs controls.

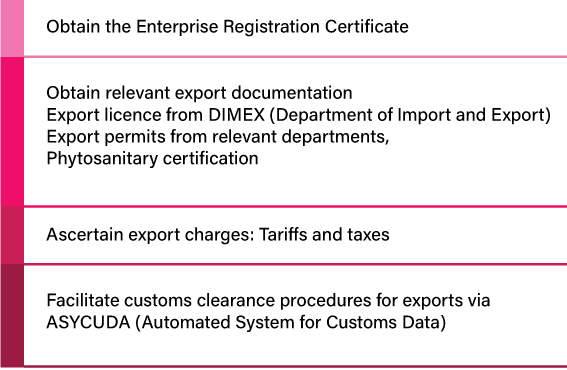

Key steps for trader to engage in exports

Lao PDR traders seeking to engage in exports from Laos have to adopt the steps demonstrated below and further elaborated on EU EBA Guide

Key elements for Lao PDR’s exporters to the EU to benefit from EBA Preferences

In order to export to the EU and benefit from the EBA preferences, traders from Laos need to account for the following aspects and further elaborated on EU EBA Guide

- Check eligibility of products and corresponding tariff rates.

- Check rules of origin criteria Register with the EU’s Registered Exporter System.

- Ascertain relevant charges, in addition to tariff duties.

- Import documentation into the EU – the single administrative document.

- Potential for application of special safeguard measures

Other tools/resources available for Lao PDR exporters to the EU

Lao traders are also able to make use of various resources made available by the EU and the Government of Lao PDR in order to enable them to engage in exports

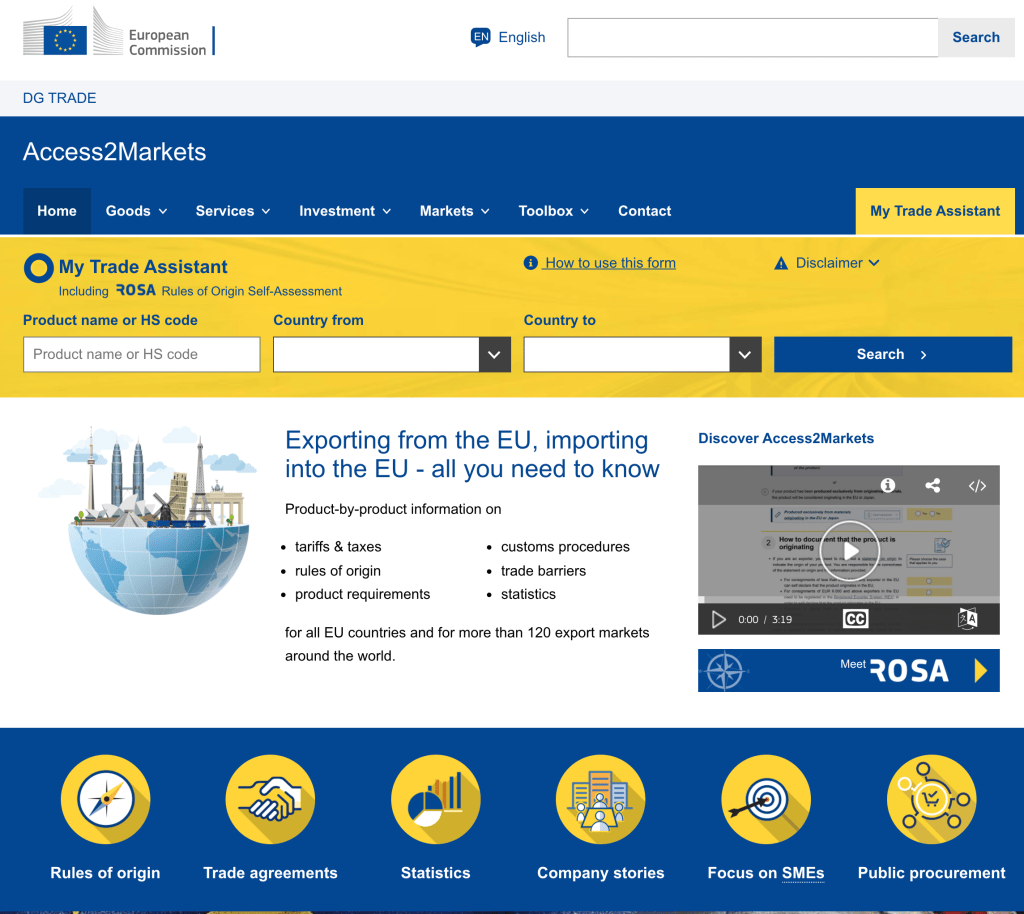

The EU’s AccessMarkets online Portal

The EU’s AccessMarkets online portal has the objective to better explain trade agreements and preferential trading schemes and help companies to understand whether their products are eligible for reduced tariffs.

The portal allows users to look up the following details for imported and exported goods:

– Tariffs;

– Taxes;

– Rules of origin;

– Product requirements;

– Customs procedures;

– Trade Barriers;

– Trade flow statistics.

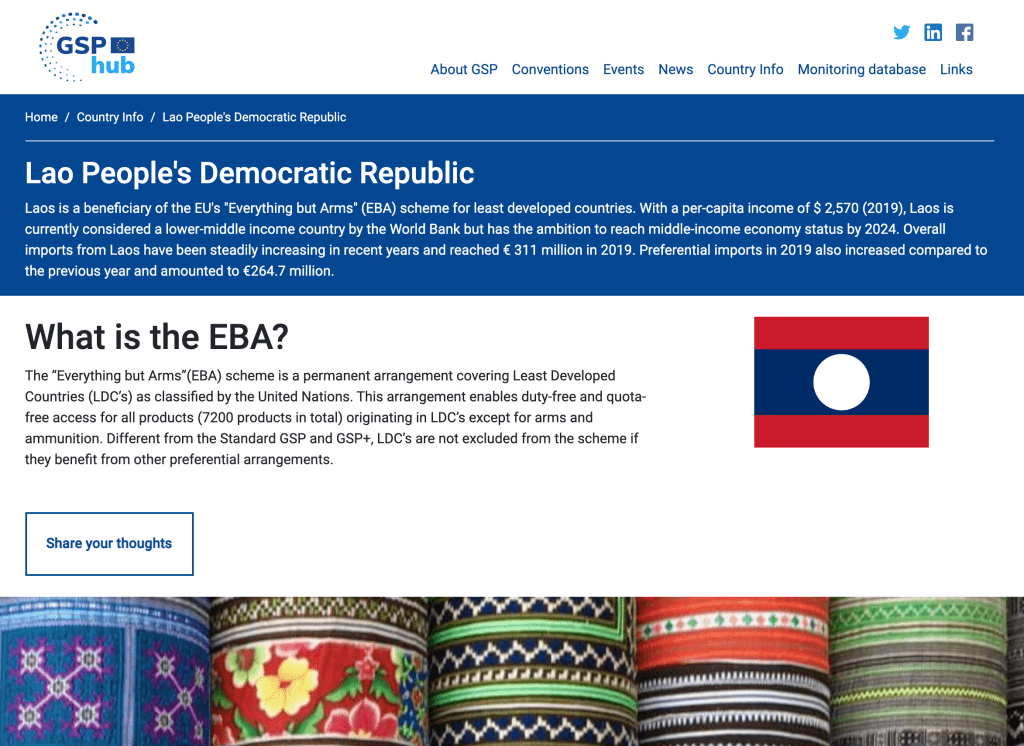

The EU’s GSP Hup

The site provides a monitoring database, dedicated country pages for all GSP beneficiary countries, a dedicated business engagement forum and general information of the EU’s GSP. The website also provides a webpage with the conventions entered into by the GSP countries.

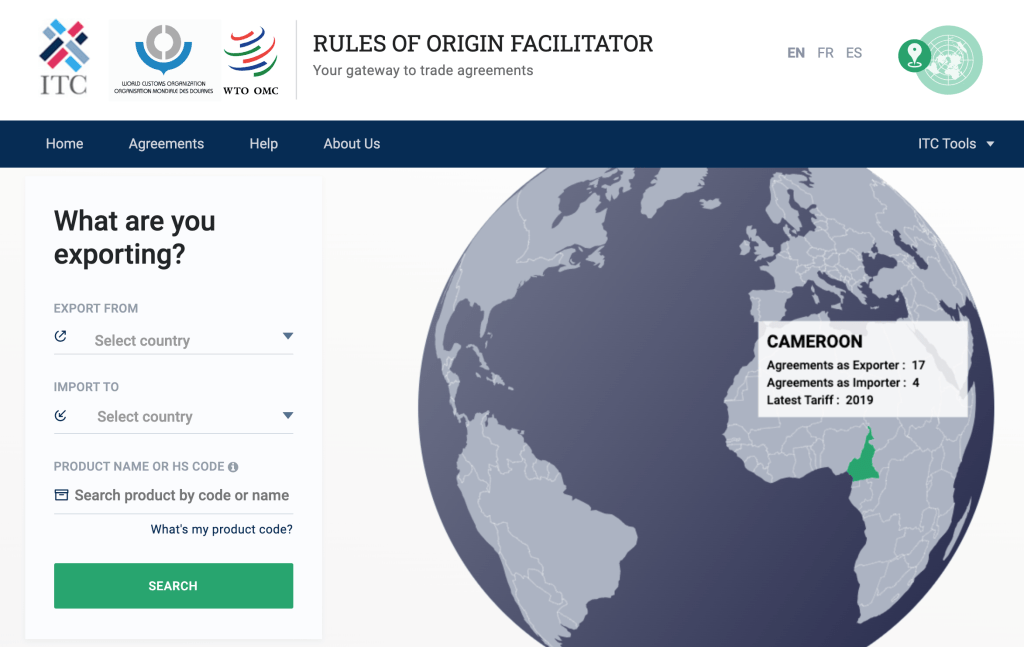

The ITC Rules of Origin Facilitator

ITC’s Rules of Origin Facilitator provides user-friendly access to ITC’s database of rules of origin and origin provisions in trade agreements. The database of rules of origin currently contains data for more than 350 trade agreements applied by more than 190 countries.